Articles

Understanding IRS Letter 5699: Penalties, Steps to Take, and How United ACA Solutions Can Help

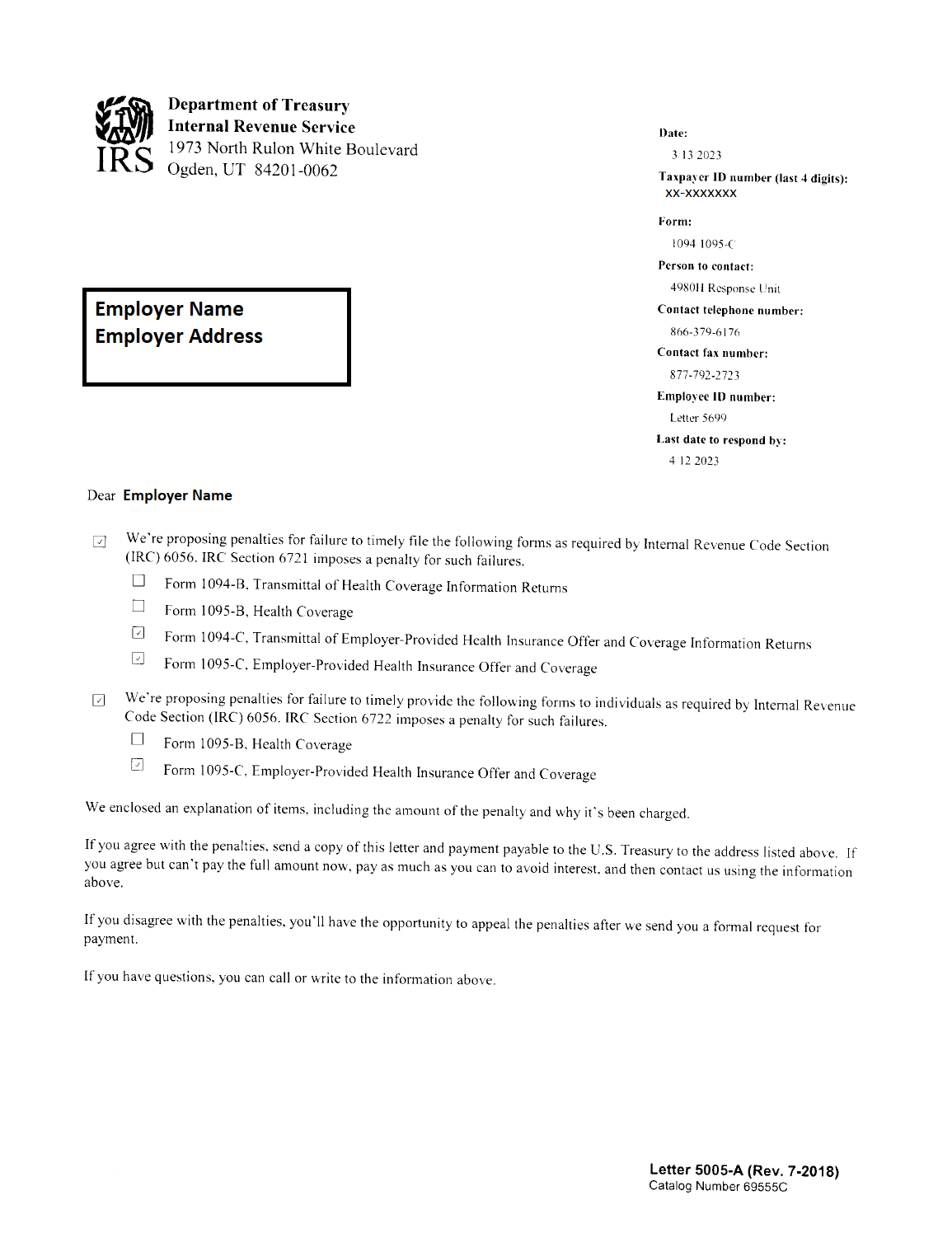

The Internal Revenue Service (IRS) enforces the Affordable Care Act (ACA) reporting requirements seriously and sends Letter 5699, or the "Missing Information Return" letter, to non-compliant employers. The article explains how the IRS determines who should receive the letter, the penalties associated with non-compliance, and the steps employers should take if they receive the letter. It also provides information on how United ACA Solutions can help prepare and file prior year 1094-C and 1095-C forms for employers. The penalties for failing to furnish and file the required ACA information returns have been adjusted for inflation since 2015, and United ACA Solutions offers prior year reporting services to assist employers in staying compliant.

IRS Letter 226J: Everything You Need to Know

As an Applicable Large Employer, it's critical to understand the ACA's Employer Mandate to avoid costly IRS penalties. Many employers are receiving penalty notices based on inaccurate or conflicting data. United ACA Solutions provides expert-level understanding and assistance with navigating the Employer Mandate, ensuring compliance and avoiding penalties.